Best Way to Explain WHAT IS ETHEREUM (ETH) STAKING AND WHERE CAN YOU DO IT?

Since the “Merge,” Ethereum (ETH) staking has taken the globe by storm, allowing users to lock in tokens to validate transactions and get payments. But why is Ethereum Staking gaining popularity, and how does it help people? How can you stake Ethereum across several platforms? To answer all of these questions, we’ve written this essay to give you a thorough understanding of the Ethereum (ETH) staking environment.

Cryptocurrency investors have made a lot of money by staking their digital assets to grow their holdings without having to sell them. Similarly to putting money in a bank, crypto staking refers to putting up one’s own cryptos in order to acquire the right to a portion of the benefits.

vouch for the accuracy of transactions on a blockchain network.

In a nutshell, it is a method of creating passive income that can be compared to receiving interest or dividends while hanging onto your underlying assets. The technique also aids the network’s decentralization by distributing consensus to thousands of validators who ensure the transactions. It is crucial to remember, however, that not all crypto networks use staking.

Staking is available on digital assets like as Ethereum (ETH), Solana (SOL), and Cardano (ADA), among many others that run on Proof-of-Stake (PoS) blockchains. Network participants who want to help the blockchain by validating new transactions and adding new blocks must “stake” a certain amount of their digital tokens under this method.

WHAT ROLE DOES ETHEREUM (ETH) PLAY?

To further grasp what ETH staking is, consider what the original Ethereum looked like and what the shift to Ethereum 2.0 entails. The Ethereum blockchain, like Bitcoin (BTC), was initially established using the proof-of-work (PoW) consensus process.

This means that miners of its native currency Ether (ETH) would have to spend an incredible amount of computer power to decrypt and validate users’ transaction data. The decryption process was complicated, necessitating large gas fees and exorbitant technology prices.

The Ethereum blockchain underwent the Merge upgrade in 2022 to make the network more energy-efficient, shifting to a proof-of-stake (PoS) consensus mechanism. The new consensus requires validators to pledge a specific amount of cryptocurrency to the blockchain, thereby turning them into transaction participants.

authenticators.

This, in turn, lowered the amount of money spent on gas fees and hardware expenditures when compared to the previously used PoW strategy. Staking has become an increasingly essential aspect of the Ethereum (ETH) ecosystem since its transition.

Ethereum staking is the process of validating transactions on the Ethereum blockchain network that allows users to lock in, or stake, the platform’s native coin, ETH, in order to earn rewards and help secure the network.

These individuals are known as “validators” or “stakers,” and they are in charge of processing transactions, storing data, and adding blocks to the Ethereum blockchain. Validators can obtain incentives and interest on their staked coins as a reward for their active participation in the network.

HOW DOES STAKING ETHEREUM WORK?

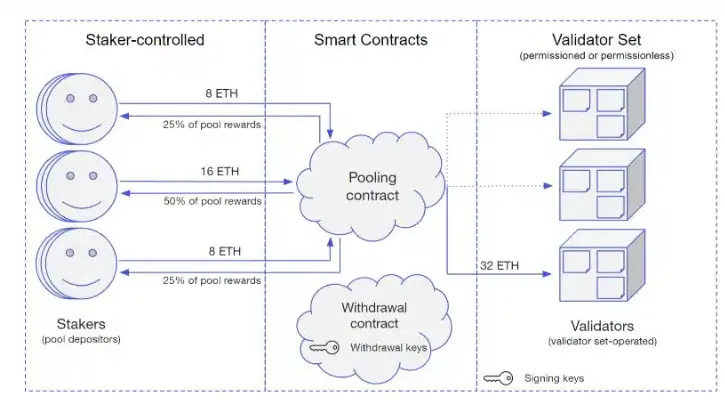

To become a validator, users must deposit 32 ETH or join a collective staking pool, where they stake a percentage and receive rewards based on their contribution. The users must then obtain validation rights and program their node accordingly. Once configured, the validator must wait for a transaction to be selected as part of the block production process.

The Ethereum blockchain bundles 32 blocks of transactions during each round of validation, which lasts an average of 6.4 minutes. “Epochs” are these groups of blocks. Simultaneously, stakers are randomly divided into 128 “committees” and allocated to a specific shard block.

These 128 individuals are chosen at random from the general pool of Ethereum validators for the duration of the epoch. Once a committee is assigned to a block, one of the group’s 127 members is given the exclusive power to propose a new block of transactions, while the remaining 127 members vote on the proposal and attest to the transactions.

Once the new block has been attested by a majority of the committee, it is added to the blockchain and a “cross-link” is formed to confirm its insertion. The Ethereum staker that was chosen to propose the new block is only then rewarded. The process is repeated in its entirety, which might take anything from a few seconds to several hours depending on network congestion.

HOW MUCH ETHEREUM DO I NEED TO PLACE?

To become a validator on the Ethereum blockchain, each individual must have at least 32 ETH staked. Validators, on the other hand, can allow smaller ETH holders to delegate their tokens to them and therefore earn a portion of their staking rewards.

If a person wishes to stake ETH for profit without becoming a validator, they can always join a staking pool. They can combine a much lesser quantity of ETH with other pool members in a staking pool to boost their chances of validating a block and receiving rewards.

HOW MUCH DO YOU EARN FROM ETH?

The current annual percentage yield (APY) for on-chain ETH staking is roughly 4%-5%. It indicates that investors having $1,000 in Ethereum (ETH) can expect to earn roughly $43 each year. Users can expect to receive roughly $220 for a $5,000 ETH investment. In fact, if the price of Ether rises, the overall value of the users’ stakes will rise as well, increasing their return.

WHICH ARE THE BEST PLACES TO INVEST IN ETHEREUM (ETH)?

Staking Ethereum is a terrific method to earn rewards, but it’s crucial to know which platforms provide the best user experience and benefits before putting up any of their valuable assets. Let’s have a look at the finest platforms for ETH staking in this section.

Rockets of Pool

It is one of the most popular Ethereum (ETH) liquid staking services, allowing users to stake ETH in a pool or independently while running a node. Users do not require 32 ETH to stake individually on Rocket Pool in this case. In actuality, an individual only needs 16 ETH, which is half of the normal amount.

A user can presently earn a reward rate if they stake and run a node using Rocket Pool.

APRs as high as 6.36% are available. If they want to stake without running a node, however, they can still earn a reward rate of roughly 4.03% APR. When using Rocket Pool, however, users must lock up their ETH during the staking procedure.

Lido

Unlike Rocket Pool, Lido is an Ethereum-based liquid staking platform that also functions as a decentralized autonomous organization (DAO), allowing users to stake any amount of Ethereum (ETH). Within its pools, the platform employs staked ETH (stETH), an ERC20 token tied to Ethereum. This is offered to users as a representation of the Ethereum they have placed during the staking process. Lido presently charges a 10% fee and offers a yearly return rate of 3.7% on Ethereum staking.

Ankr

ETH of Ankr Ankr Stakers can employ liquid staking to create new tokens such as aETHb and aETHc that they can immediately trade or use to increase their earnings on decentralized finance (DeFi) platforms. Stakeholders avoid locking up the value of their ETH in this manner, allowing them to gain in many places at the same time. Ankr provides a 4.36% annual percentage yield.

BEST WALLETS TO STAKE ETHEREUM (ETH)

Users require an Ethereum wallet in order to participate in the Ethereum ecosystem and securely store, transfer, receive, and stake Ether (ETH). While all popular cryptocurrency wallets offer a high level of protection, we’ve developed a list of the top three wallets for Ethereum (ETH) staking.

The Atomic Wallet

This is a cryptocurrency wallet that allows users to interact with the ETH ecosystem directly and stake ETh tokens in exchange for APY incentives. they can earn up to 5.5% APY on the atomic wallet, making it easier for consumers to stake their ETH holdings because all they have to do is deposit the coin and select the validator to stake their ETH.

Furthermore, users can estimate how much ETH they will make.

visit the official website of Atomic Wallet. Overall, this wallet is an excellent option for staking for those who do not want to spend the initial expenditures associated with a hardware wallet.

Wallet Guarda

Guarda is the second-best wallet option on our list, with up to 3% APY for staking Ethereum. Guarda wallet is a multi-asset crypto wallet that allows users to store, send, and receive Ethereum (ETH) and Ethereum-based tokens securely. This wallet’s minimum staking value is 0.1 ETH. This wallet has excellent security features and allows users to earn, borrow, and transfer digital assets.

MetaMask

Last but not least, MetaMask is one of the most popular blockchain wallets accessible today as a browser extension to allow users store tokens.

Interact with decentralized applications (dApps) and trade Ethereum (ETH) tokens. Because it is a non-custodial wallet, users have complete control over their private keys and may access their wallet from any browser.

Institutions who use MetaMask’s institutional-grade wallet and custody service can now handle their Ether (ETH) staking through four different vendors, including ConsenSys Staking, Allnodes, Blockdaemon, and Kiln. As previously indicated, although Ethereum staking rewards rates vary, MetaMask claims customers can earn 5.22% per year on ETH deposits with Lido and 4.59% with Rocket Pool.

Final Though

As a result, Ethereum (ETH) staking is analogous to owning a stock that pays dividends. It may not seem like much in the short run, but consistency over time is where genuine gains may be made. Although the dividend may appear insignificant at first, it has the potential to become a considerable source of revenue in the future, especially if Ethereum continues to climb in value as it has in recent years. According to Habeeb Syed, a senior associate attorney with Vicente Sederberg LLP,

“Staking Ether is a low-risk way to invest your tokens.” If you don’t want to go to the hassle of creating your own validator, you may always use a centralized exchange or other platform that provides validators.simpler choices.”