How to Use OCO Orders (One-Cancels-the-Other) in Your Crypto Trades

Are you a crypto trader looking to streamline your trades? Find out how OCO orders (one-cancels-the-other) can help you manage risk and optimize your trading strategy.

One-Cancels-the-Other (OCO) Orders are becoming increasingly popular in the crypto trading world. Learn how to use this smart tool to improve your trades now!

What is OCO Orders (One-Cancels-the-Other) in Your Crypto Trades

An OCO order is a way to place two different types of orders, such as a stop order and a limit order, at the same time. These orders are paired together so that when one order is executed, the other order is automatically canceled. This allows traders to manage their risks and set specific entry and exit points for their trades instantly and world wild.

in the other word, (OCO) order consists of a pair of orders that are created concurrently, but it is only possible for one of them to be executed. This means that as soon as one of the orders is fully or partially filled, the other is canceled automatically. Although less common, OCO orders may also be referred to as Order Cancels Order.

It’s important to note that the paired orders cannot be executed at the same time, as the execution of one order triggers the cancellation of the other as the name suggests. By using OCO orders, traders can automate their trades and reduce the need for constant monitoring of the market.

Why Do Traders Use OCO Orders?

One-Cancels-the-Other (OCO) Orders are becoming increasingly popular in the crypto trading world, it is clear that OCO orders are suitable for traders that fall into the following categories:

- Traders looking to limit their exposure to risks: The possibility of simultaneously setting stop-loss and take-profit orders keep the potential risks at a bare minimum without diminishing the profitability of the trade.

- Traders looking to manage their emotions when trading: Experienced traders understand that it is crucial to keep emotions in check during trading. This is particularly true when deciding the best entry and exit point of a highly volatile market. Fortunately, the OCO order technique helps traders set a predefined goal, thereby reducing the occurrence of emotion-based errors.

- Traders looking to enjoy an operational advantage: Since OCO allows traders to automate the execution and cancellation of orders, they do not need to track price movements consistently or execute trades manually. Considering that OCO enables the implementation of profit optimization and risk management strategies, traders have spare time to analyze other markets or perform other activities.

How to Use OCO Orders?

Now that you understand the fundamentals of a stop order and a limit order, below is how you can pair the two order types to implement an effective OCO order.

As mentioned earlier, an OCO order helps manage risks. It is also an ideal option for traders looking to determine the best entry and exit points. Depending on the goals of a trader, there are three scenarios where an OCO order can be used.

Risk Management in Open Positions

Traders or investors commonly set OCO orders when they have an open position. In such scenarios, traders look to limit the risk bearing in mind that the market can move against them. Also, the OCO order ensures that traders do not lose out on profit-earning opportunities when the market moves in their favor.

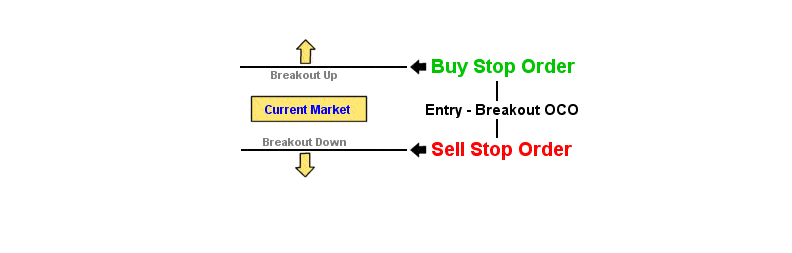

Targeting Price Breakouts

OCO orders are also effective when the price of an asset seems to trade within a defined range and is poised for a breakout.