What Are Automated Market Makers? Best way to explain

Automated Market Makers facilitate traders to interchange with smart contracts programmed to enable liquidity and discover cost. While this summarizes the concept of AMM, meaning automated market makers slog around the clock to bring down price volatility by furnishing the appropriate level of liquidity.

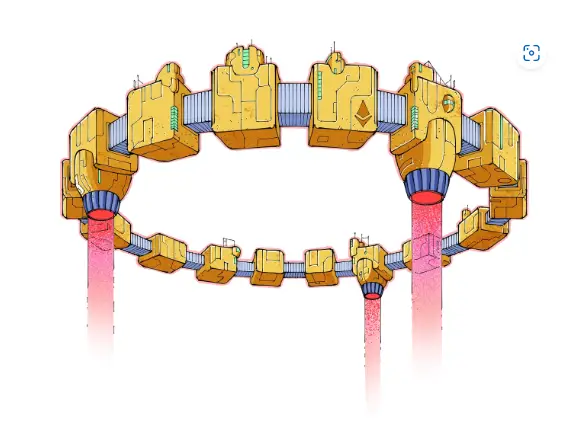

Contrary, centralized exchanges, decentralized trading protocols do away with order books, order matching systems and financial entities assuming as market makers: some examples are Uniswap, Curve and Balancer. The goal is to eliminate the input of third parties so that investors can execute trades directly from their personal wallets. Hence, a majority of the processes are executed and governed by smart contracts

How Do AMMs Work?

AMMs or Automated Market Maker utilize preset mathematical formulas to locate and maintain the prices of paired cryptocurrencies. further, AMMs stand for automated Market Makers allow investors or trades to provide liquidity for paired assets. The protocol facilitates investors to become a liquidity provider.

While there are a variety of access to AMMs which stand for Automate Market Makers as exemplified by Uniswap and Balancer, the fact remains that they require liquidity to function properly and negate slippages meaning investors receive transaction fees when he or she provide capital for running liquidity pools no matter where investors live

Once investors stake fund, they will receive liquidity provider tokens that denote investors share of the liquidity deposited in a pool. These tokens also make investors acceptable to receive transaction fees as passive income. investors may deposit these tokens on other protocols that accept them for more yield farming opportunities. in order for investors to withdraw liquidity from the pool, investors would have to turn in he or her LP tokens.

During recent years, Automated Market Makers have proven to be innovative program for enabling decentralized exchanges. In this time, we have witnessed the emergence of a slew of DEXs that are driving the ongoing Decentralized finance hype. While this does not mean that the approach is flawless, the advancements recorded in the last 12 months are symptomatic of the several possibilities that AMMs provide. It remains to be seen where we go from here. what you guys think?