What Are the Differences between Margin and Futures Trading

Binance Margin trading is a method of trading crypto assets via borrowing funds, and it allows traders to access greater sums of capital to leverage their positions. Essentially, margin trading amplifies trading results so that traders can realize larger profits on successful trades.

A Futures Contract is an agreement to buy or sell the underlying asset at a predetermined price in the future. When trading Futures, traders can participate in market movements and profit by going long or short on a futures contract. Binance Futures Contracts are divided according to the different delivery dates into Quarterly and Perpetual Futures Contracts.

Margin and Futures trading allows users to amplify their profits by using leverage. But what’s the difference between the two products? Let’s dive in for better understanding!

Markets & Trading assets

Margin Traders place orders to buy or sell cryptos in the spot market. This means that margin orders are matched with orders in the Spot Markets. All margin related orders are actually Spot orders. While trading Futures, traders place orders to buy or sell contracts in the derivatives market. In summary, Margin and futures trading are in two different markets.

Leverage

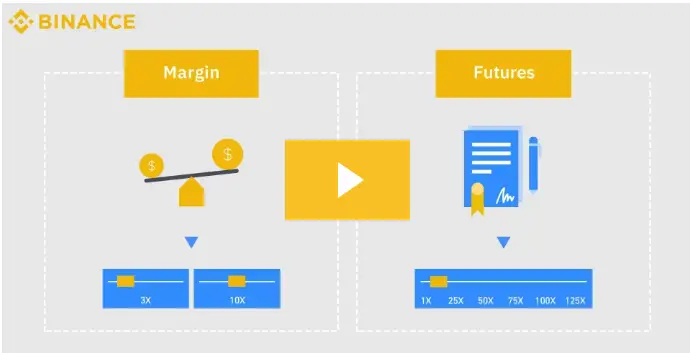

Margin Traders have access to 3X~10X leverage with assets provided by the platform. The leverage multiplier is based on whether you are using isolated margin or cross margin mode. In contrast, futures contracts offer higher leverage.

Collateral Allocation

Binance Futures and Binance Margin trading both allow traders to switch between “Cross Margin” and “Isolated Margin” modes. So, traders can allocate their funds to a cross position or isolated positions to reasonably share the collateral to control risks.

Trading Fee

Binance Margin allows users to borrow funds from the platform and calculates the loan’s interest rate for the next hour. Users will repay the borrowed funds afterward. Traders should make sure that their assets are sufficient to avoid being liquidated.

In contrast, Futures are using maintenance margin as collateral, which means there is no repayment, but users should make sure that their collateral is sufficient.

Both Margin and futures will charge users a trading fee. And Margin’s trading fee is the same as the Spot’s fee.

And due to the price difference between Perpetual Futures and Quarterly Futures, the funding rate is used to essentially force convergence of prices between the Perpetual Futures Market and the actual underlying asset. Please note only Perpetual Futures will charge traders the funding rate.