Best Way to Explain What Is Binance DeFi Staking and How to Use It

Binance DeFi stands for “Decentralized Finance”. Unlike CeFi (Centralized Finance), our existing monetary system, DeFi provides users with decentralized financial services through smart contracts on a blockchain.

Binance DeFi Staking

DeFi projects (Dapps) have not been fully adopted for two main reasons – lack of public awareness and complicated and non-intuitive user interface. This is why Binance introduced DeFi staking to help proxy users to participate in related decentralized projects. This allows users to access DeFi in a user-friendly and straightforward manner. Without the need to manage private keys, acquire resources, make trades, or perform other complicated tasks required to participate in DeFi Staking. By simply clicking [Stake now], you can participate in DeFi Staking projects and earn high returns easily and safely.

How to participate in DeFi staking on Binance

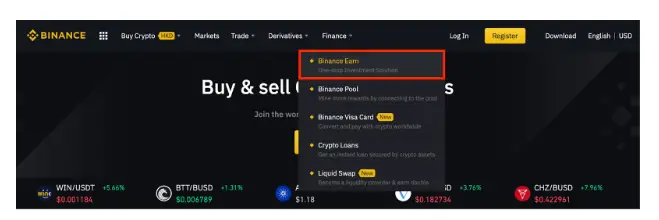

Login to your Binance account, click [Finance] – [Binance Earn].

Scroll down to [Locked Staking] and click [View More].

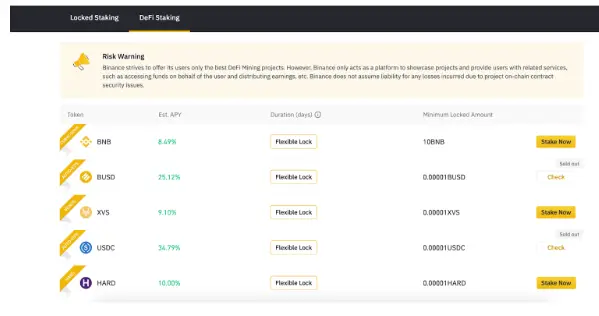

Click [DeFi Staking] and you can see all the DeFi staking projects currently available in Binance Earn with an estimated annual yield, staking duration (flexible or fixed), minimum locked amount, and the staking status.

Once you choose the asset you want to stake, click [Stake Now] to see details about this staking offer.

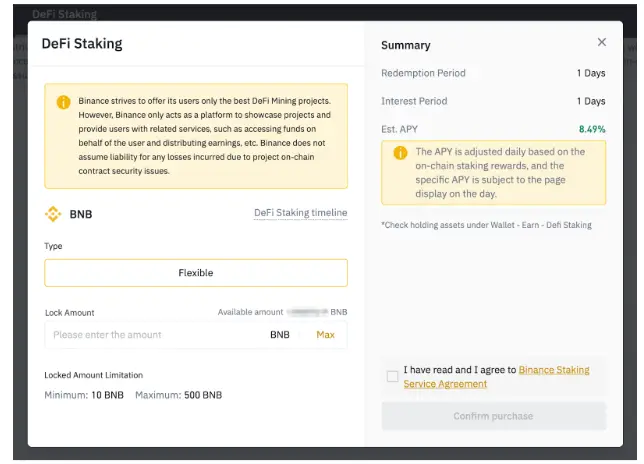

You can choose either Flexible or Locked staking and adjusting the duration. You will then see the [Estimated annual percentage yield (est. APY)].

- “Flexible” allows you to redeem your staked assets at any time. When you choose to redeem, we’ll return your assets to your Spot Wallet the following day.

- “Locked” refers to staking your assets for a specific time frame. Compared to Flexible Staking, Locked Staking provides higher interests but requires you to lock your assets for the displayed duration. You can still redeem your assets at any time you wish before the end of the locked duration, but you won’t receive any interest generated over your staking period. Your staked assets will be unlocked and returned to your Spot Wallet the following day.

*During the staking period, your assets will be locked on-chain, so you won’t be able to withdraw or perform any transactions with the staked assets.

[Available amount] shows the available balance in your Spot Wallet that you can use to stake on Binance Earn. There is a minimum required limit for staking, and if your balance is lower than that, you won’t be able to stake. Also, please note that if the total remaining quota of the product is lower than your available balance in your Spot Wallet, you will only be able to purchase the remaining amount for staking.

Enter the [Lock Amount] you want to stake, check the Staking Summary on the right, read and agree to Binance Staking Service Agreement and click [Confirm purchase].

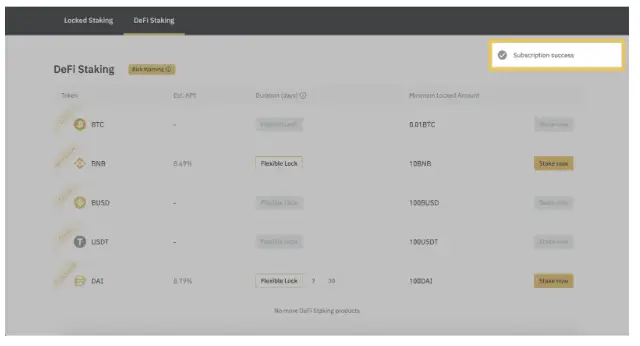

You can find your staking details from [Wallet] – [Earn] – [DeFi Staking]. Once you staked the product successfully, interests will be calculated starting at 00:00 (UTC) the following day and distributed to your Spot Wallet every day after 00:00 (UTC).

For Locked Staking, when the staking period ends, your staked assets will be redeemed automatically and the funds will be returned to your Spot Wallet.

If you want to redeem your assets before the locked period ends, click [Redeem earlier]. Please note that unlocking your staked assets requires a specific time based on the specifications of the chain you’re staking on. If you redeem your staked assets in advance, you will lose your interest and the interests you have generated will be deducted when your assets are returned.

Risk Warning

Binance strives to offer its users only the best DeFi Mining projects. However, Binance only acts as a platform to showcase projects and provide users with related services, such as accessing funds on behalf of the user and distributing earnings, etc. Binance does not assume liability for any losses incurred due to project on-chain contract security issues.

What are the advantages of DeFi Staking?

- Easy to use: You don’t need to manage multiple private keys, acquire resources, make trades, or perform other complicated tasks to participate in DeFi Staking. Binance’s one-stop service allows users to obtain generous online rewards without having to keep an on-chain wallet.

- Higher earnings: The fees required for DeFi Staking are low. Users are able to earn the highest possible returns in the best way, while maintaining the same level of risk.

Binance only acts as a platform to showcase projects and provide investors world wild with related services, such as accessing assets on DeFi projects through a proxy and distributing earnings and more Binance does not bear any liability for losses incurred as a result of on-chain contract security.also

DeFi Staking on binance subscriptions are closed during 23:50-00:10 (UTC) daily world wild for all investors. No interest is accumulated on products purchased on the day of the subscription. Once funds are successfully allocated to Locked Staking, earnings are calculated beginning at 00:00 (UTC) the following day. The minimum earnings calculation period is one day; earnings for a period of less than one day will not be included in the earnings distribution.last but not least

Currently, the lock-up period for regular products is 1 day. Meaning Funds will be unlocked and returned to investors Spot Wallet on T + 1. However, as binance support more types of products, the lock-up periods will vary. investors can check the lock-up periods for different products from Binance Earn official website. let us know in the comment section what you think about the binance defi staking.